In 2021, strong economic growth and more favorable weather conditions increased global electricity demand by more than 6%, an increase since the recovery from the financial crisis in 2010. The overall rapid rebound in energy demand has strained coal and natural gas supply chains, pushing up wholesale electricity prices. Despite impressive growth in renewables, coal and natural gas power generation has hit record highs, causing annual CO2 emissions from the global power sector to rebound after declining in the previous two years. Based on the analysis of these recent events, the January 2022 edition of the Energy Agency's Electricity Market Report provides projections of demand, supply and emissions in the global electricity market until 2024. While renewables will meet the vast majority of the increase in global electricity demand in the coming years, this trend will only lead to a leveling off of emissions on the generation side. None of these realities are sufficient for the power sector to live up to its responsibilities as a leading force in decarbonizing the global economy.

(Source: Compiled by Li Tianjiao, WeChat public account "China Electric Power Enterprise Management")

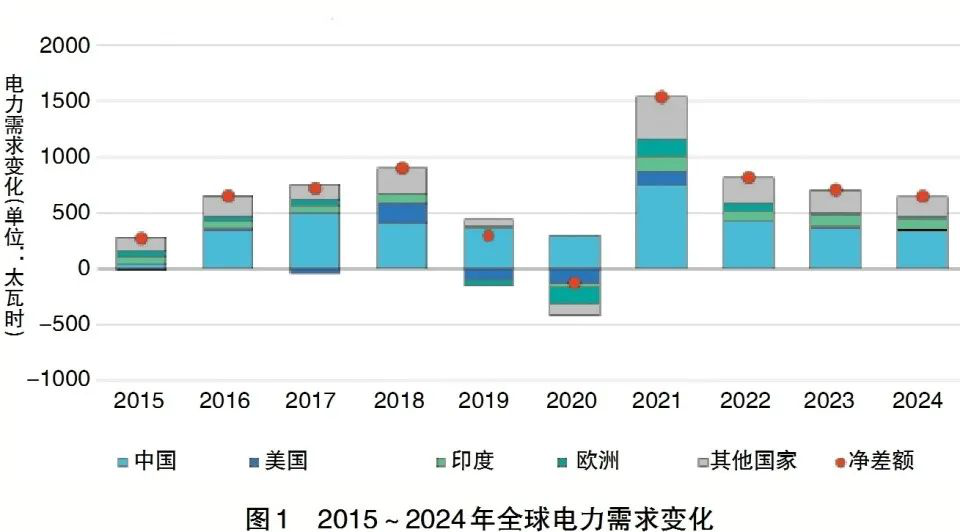

Supply, demand and emissions

After strong growth in 2021, electricity demand growth will slow down in the coming years. After a slight decline in global electricity demand in 2020, it grew by about 6% in 2021. This is an annual absolute increase on record (more than 1.5 trillion kWh) and a relative increase since the recovery from the financial crisis in 2010. According to statistics, the contribution of industry to the growth of demand, followed by commerce and services, and then residential electricity. There are three main reasons for the continued strong growth in demand: First, the economy continues to recover. Second, the rebound in the energy sector will continue in 2022, as pandemic prevention measures in 2021 may have dampened electricity demand. The gradual easing of the energy crisis due to supply shortages and high energy prices in the fourth quarter of 2021 will also boost economic growth. However, developments in energy prices and the coronavirus pandemic are major uncertainties in the demand outlook. Global electricity demand growth is expected to slow in 2023 and just over 2% in 2024 as the rebound fades and energy efficiency measures begin to take effect. Most of the electricity supply growth is expected in China in 2021~2024, accounting for about half of the total net growth, followed by India 12%, Europe 7% and United States 4% (see Figure 1).

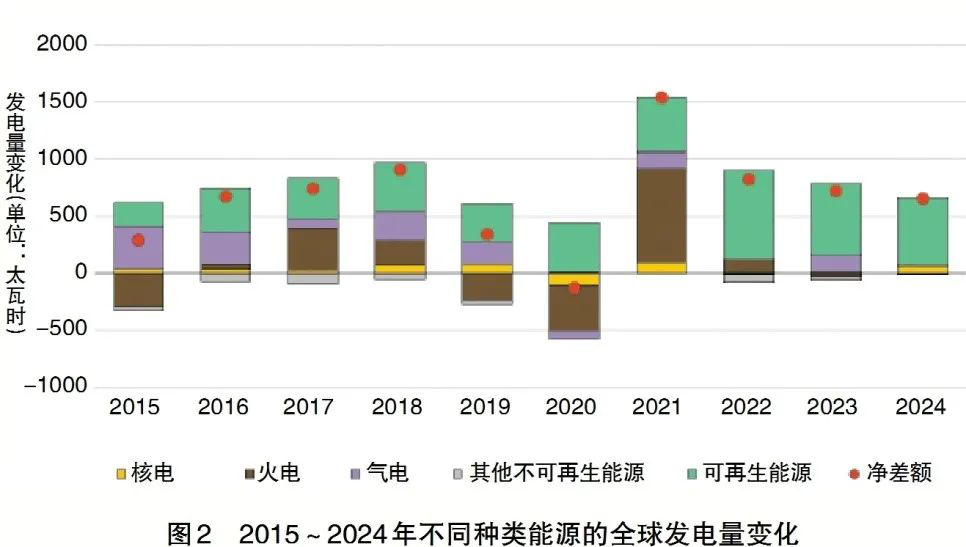

Total thermal power generation grew by almost 6% (9.8 trillion watts) in 2021, the highest increase since 2010, due to strong growth in electricity demand, unfavourable conditions for renewable energy construction, and rising natural gas prices. Coal-fired power generation grew by about 9%, a record high. In 2021, coal met more than half of all new electricity demand, outpacing renewables in absolute terms for the first time since 2013. Gas-fired electricity increased by 2% globally, offset the decline in 2020 due to high natural gas prices. In 2021, low-carbon electricity generation increased by 5.5% (5.55 trillion watts), of which 83% was renewables. Despite unfavourable weather conditions, the absolute growth rate of renewable energy generation in 2021 was 6% on record. Nuclear energy grew by around 3.5%, close to 2019 levels.

The outlook for electricity in 2022~2024 is very different from that in 2021. Assuming weather conditions return to long-term averages, renewables are expected to be the main source of electricity supply growth in the coming years, with an average annual growth of 8%. By 2024, renewable electricity will account for more than 32% of the world's total electricity supply (up from 28% in 2021), and low-carbon power generation is expected to rise from 38% in 2021 to 42%.

Fossil fuels are still expected to account for 58% of total electricity generation by 2024, down from 62% in 2021. Coal-fired power generation will account for 34% of global electricity generation, down from 36% in 2021. In 2021, electricity generation returned to pre-pandemic levels in 2019 and gas-fired electricity is expected to grow at an average annual rate of 1% until 2024, but this growth is expected to occur mainly in 2023, with long-term forecasts pointing to a return to lower levels (see Figure 2).

Emissions from the global power sector surged in 2021 and are expected to remain flat in 2022~2024. After declining in 2019 and 2020, global emissions from the power sector reached a new all-time peak in 2021. Coal is the main driver of this growth, causing CO2 emissions to rise by more than 800 million tons. The slowdown in demand growth and the continued growth of low-carbon power generation after 2021, combined with the slow growth of gas and coal power emissions, will make the annual emission growth in 2022~2024 much less than 1%. By 2024, more than 1.3 billion tonnes of CO2 will be emitted from electricity generation.

In 2021, the carbon intensity of global electricity generation increased by 1%. Carbon intensity is expected to decrease by an average of 2% per year in 2022~2024, as low-carbon energy sources will meet most of the new demand at this stage. Although the global carbon emission intensity has decreased by 78% in 2021~2024, accounting for 95% of global consumption, there are still great differences in the emission reduction rates in different regions. Large-scale changes in energy efficiency and low-carbon supply will take place for the power sector to play a key role in decarbonizing the broader energy sector.

In 2021, fossil fuels are back on the scene

Natural gas and coal prices surged to multi-year highs in the second half of 2021 due to tight supply and demand. On the supply side, both gas and coal capacity are facing constraints due to arduous maintenance work and unplanned shutdowns. Tight supply in the northern hemisphere summer market led to a slow increase in natural gas and coal inventories, putting further upward pressure on prices in the second half of 2021.

In the United States, the price of natural gas at the Henry Hub reached $4.6/MBtu in the second half of 2021, more than doubling over the same period and is the same period since 2008. In contrast, the price level of coal is more stable. Compared to the same period in 2020, the fuel cost of coal-fired power increased by less than 6% in the second half of 2021. This has increased the cost competitiveness of coal-fired power over gas-fired power, leading to a large number of "natural gas to coal" conversions. In 2022~2024, improvements in supply reliability will put downward pressure on natural gas prices, with prices at the Henry Hub averaging 12% lower than 2021 levels based on the forecast curve as of early January 2022. Despite this, compared to the situation in 2018~2020, coal power is still more competitive than gas power.

In Europe, gas prices from the Netherlands Transfer of Rights Fund (TTF) soared to historic levels in the second half of 2021 as supply struggled to meet high demand, followed by coal prices. While coal prices in both the EU and the United Kingdom have hit record highs, high gas prices have exacerbated the "natural gas to coal" switch. The forecast curve shows that in 2022~2024, the price of natural gas will be 5% lower on average than in 2021, improving the cost competitiveness of gas-fired power compared to coal-fired power. High gas and coal prices and emissions subsidies in the EU and United Kingdom have pushed up the cost of generating electricity at coal-fired power plants and put upward pressure on electricity prices.

Compared to 2020, United States coal electricity increased by 19% and Europe by 11%, while gas electricity in United States fell by 3% and Europe grew steadily at 4%. Coal power is expected to decline again in the coming years as natural gas prices ease, and the situation in 2021 provides a good sample for a generation flexibility analysis. The ability to switch between different fuels can be used as an indicator of the resilience of the system.

The Energy Agency's study of regional markets in Germany, Netherlands and the United States found that switching natural gas and coal fuels showed a strong correlation with the difference in power generation costs.

In the second half of 2021, natural gas prices in Japan and Korea were not as strong as in other regions, while coal prices soared to record highs. According to the forecast curve, coal-fired power generation will return to its cost competitiveness in the medium term, and in 2022~2024, coal prices will be on average 10% lower than in 2021.

The tightening of the coal market has had serious implications for both China and India. As of 2020, China and India had more than 60% and 70% of coal power, respectively. Widespread high gas prices have led to frequent "gas-to-coal" conversions in several major power markets, pushing up coal demand and prices in the second half of 2021. In addition, meteorological events such as floods in Indonesia have also limited the use of coal. High coal prices and limited supply have increased dependence on local coal resources. In addition, before India's monsoon season, power plants have insufficient coal reserves, with more than 80% of India's coal power plant fuel stocks reaching critical levels in October, leaving less than a week's supply.

Wholesale electricity prices continued to rise in 2021

Soaring natural gas and coal prices were the main reasons for the rapid increase in wholesale electricity prices in many countries in 2021. Compared to 2020, the price index in the main wholesale electricity markets in advanced economies has almost doubled (up 64% from the average of 2016~2020).

In the fourth quarter of 2021, the wholesale prices of France, Germany, Spain and United Kingdom were 3~4 times higher than the average of the same period in 2016~2020. This is mainly due to the sharp rise in gas prices combined with increased demand, as well as the fact that EU ETS prices more than doubled in 2021 compared to the previous year.

Wholesale prices in the Nordic region have also soared, with wholesale prices in the fourth quarter of 2021 almost 3 times higher than the average for the same period in 2016~2020 and more than 7 times higher than the same period in 2020. However, the average price in the fourth quarter of 2021 was 96 euros/MWh, which is only about half that of Western Europe.

Wholesale price growth in the United States has not been as strong as in Europe, in part because natural gas prices have risen to a lesser extent. The average price in the fourth quarter of 2021 is almost 75% higher than the average price in the same period in 2016~2020.

Japan's wholesale electricity prices peaked in the quarter due to supply shortages, and after falling in the second quarter, they rose again in the second half of 2021. The average price in the fourth quarter of 2021 is 80% higher than the average price in the same period in 2016~2020.

In Australia, limited coal-fired power generation and increased demand led to a significant 174% year-on-year increase in wholesale electricity prices in Q2 2021 (up 196% from the previous quarter). Contrary to the situation in other countries and regions, after this, prices in Australia fell by 50% from the second to fourth quarter of 2021. Rising temperatures and increased availability of renewables and dispatchable power generation have all contributed to the decline in prices.

In recent years, India's electricity generation through short-term power trading has risen significantly as a proportion of total electricity generation. However, this proportion is only 6%~7%, which is still far below the level of more mature power markets such as Europe. In the second half of 2021, wholesale electricity prices increased by 70% year-on-year due to coal supply shortages. Making up for the coal-fired power generation deficit led to an increase in spot trading volume, which increased by nearly 50% in the August~October period compared to the previous three months.

The climate protection policy is global

The impact of the power sector

Decarbonising the power sector is a central component of current climate policy. Governments are increasingly focusing on the threat posed by climate change, and climate policy has become an important factor influencing the short-, medium- and long-term development strategies of the power sector. In the National Contribution Report submitted as of November 24, 2021, many countries, including United States, have set ambitious greenhouse gas emission reduction targets: United States commit to achieve a 50%~52% reduction in greenhouse gas emissions by 2030, Japan a commitment to achieve a 46% reduction in greenhouse gas emissions by 2030, and South Africa to limit greenhouse gas emissions to 350~420Mt CO2-eq equivalent by 2030. China has also submitted a national contribution report, in addition to the "dual carbon" goal, and at the same time increase the reduction rate of emissions per unit of GDP in 2030 from 60%~65% in 2005 to more than 65%.

The power sector is a core component of the country's contribution. According to the 2021 National Contribution Report of the United Nations Framework Convention on Climate Change (UNFCCC), as of 12 October 2021, 165 National Contribution Reports representing 192 Parties covered the power sector, of which 116 were new or recently updated. In 2019, the commitments in these country contribution reports covered 94% of total global greenhouse gas emissions. Eighty-six per cent of country contributions reported a target to increase the share of renewable energy generation by 2030.

The power sector is also a key component of long-term decarbonization goals. As of 24 November 2021, 45 countries and the European Union have submitted long-term low-greenhouse gas emission development strategies to the United Nations Framework Convention on Climate Change (UNFCCC), covering more than 65% of global energy-related CO2 emissions in 2019. In addition, 18 countries and the European Union have passed legislation to achieve net-zero emissions targets by 2050 or earlier, covering more than 15% of global energy-related CO2 emissions in 2019.

These commitments also cover the power sector. In the overall net-zero target, some countries have announced that their power sector will achieve net-zero emissions by 2030 or 2030, such as Norway has already achieved net-zero emissions, Denmark has set a target of 2027 and Austria by 2030. United States, New Zealand and Germany have later target dates, with 2035 for the first two and 2045 for Germany.

Governments are taking a range of policy measures to decarbonize their economies and power sectors in line with medium- and long-term climate goals. These include specific plans to phase out unabated coal, such as France's short-term plan by 2022, and others, such as Germany as late as 2038 and Chile as late as 2040, as long-term plans. This also includes a range of carbon pricing measures. But even if these measures are fully implemented, they will not be enough to match the Paris Agreement's 1.5C target.

By the end of 2021, a total of 65 carbon pricing mechanisms were in place, with six new mechanisms covering the power sector across the board. Of particular note is the launch of China's national emissions trading system, the world's carbon dioxide emissions trading system.

In 2021, as part of the "Fit for 55" legislative package, the EU proposed wide-ranging reforms to its carbon market trading system to align with the EU's new 2030 emissions targets. Proposals for reform include lowering the emissions cap more aggressively, strengthening market stability reserves to increase resilience to future external shocks, and developing more targeted rules on carbon leakage. In particular, the Carbon Border Adjustment Mechanism (CBAM), which will impose border taxes on high-carbon products, including electricity.

The third phase of Korea's ETS began in 2021 and has undergone important reforms in six areas, including heat and electricity. The government introduced a temporary low price of 12,900 won/ton of CO2 (about 68 won/ton of CO2) in the secondary market.

In 2021, governments took initial steps to introduce carbon pricing mechanisms in the power sector. Ukraine has announced that it will launch an emissions trading system in 2025 and aims to connect to the EU ETS. Indonesia conducted a voluntary emissions trading trial in the power sector in March~August 2021 and is considering building a national carbon pricing framework, possibly starting to introduce a carbon tax in 2022 and introducing an emissions trading system. Brazil is developing mechanisms to integrate environmental benefits into the operation of the power sector and regulate the carbon trading market.

In 2021, the development of the carbon market was also boosted by the agreement of the Conference of the Parties at its 26th meeting on the framework rules for the implementation of Article 6 of the Paris Agreement. Article 6 covers the accounting of exchanges between national bilateral units, as well as the central carbon market mechanism under the United Nations Framework Convention on Climate Change. The low-carbon options of the power sector are likely to enable it to continue to play a pivotal role in the carbon market of the future.

In recent years, coal phase-out pledges have sprung up around the world. From the entry into force of the Paris Agreement in 2016 to the end of 2021, 21 countries have set a date for phasing out coal power by 2040. These countries accounted for only 3% of the world's total coal power in 2021, nearly half of which came from Germany, and Germany pledged to phase out coal power by 2030 and 2038 at the latest. The Coal-Fired Power Coalition is a coal-fired power reduction organization established by Canada and United Kingdom to accelerate the phase-out of coal-fired power. As of December 2021, 48 national governments (accounting for nearly 4% of global coal power estimates in 2021), 48 sub-national governments, and 69 organizations have joined the organization. At the 26th Conference of the Parties to the United Nations Climate Change Conference (COP26) in Glasgow in November 2021, 45 countries, the European Union, five sub-national governments and 26 organizations signed the Global Coal-to-Clean Power Transition Statement, which accounted for 12% of global coal-fired power generation. Ahead of the meeting, China, Japan, Korea and the G20 pledged to stop public funding for unabated coal power abroad by the end of 2021.

The global electricity market is being increasingly affected by climate change. While the impact of weather events may vary from country to country and region to region, building climate-resilient power markets is becoming increasingly important based on the risks posed by climate change to the stability and security of power systems. promoting the sustainable development of the industry through reliable energy services; improve the adaptability, pressure resistance and coordination of the power system to cope with climate change hazards and risks, and improve the safety and stability of the power system; Plan ahead to reduce the risks associated with climate disasters.

This article was published in the 02 issue of China Electric Power Enterprise Management in 2022, and the compiler is a reporter of this magazine

Prev:Electricity consumption from January to February 2022

Next:The reform of the electric power system has given the electric power industry wings to take off